[ad_1]

About 621 container ships were rerouted around the Cape of Good Hope by February 18, since the start of the attack.

| Photo Credit: Suez Canal Authority

Since November 2023, the Houthis, based in Yemen, have launched attacks on ships traversing the Red Sea. The Houthis say their actions are in solidarity with the Palestinians, who are caught in the Hamas-Israel war. This has disrupted trade through the critical waterway that connects Asia and Europe. Companies are re-routing their ships to avoid the Suez Canal, opting instead for the longer route around the Cape of Good Hope, the southern tip of Africa.

The Suez Canal handled 12%-15% of global trade in 2023. According to a UNCTAD report, the container tonnage crossing the canal fell by 82% in the first half of February this year. On the other hand, container tonnage passing around the Cape of Good Hope increased by 60% in the same period. About 621 container ships were rerouted around the Cape of Good Hope by February 18, since the start of the attack.

Map 1 | The map shows the route taken by container ships through the Suez Canal before attacks on the Suez Canal route.

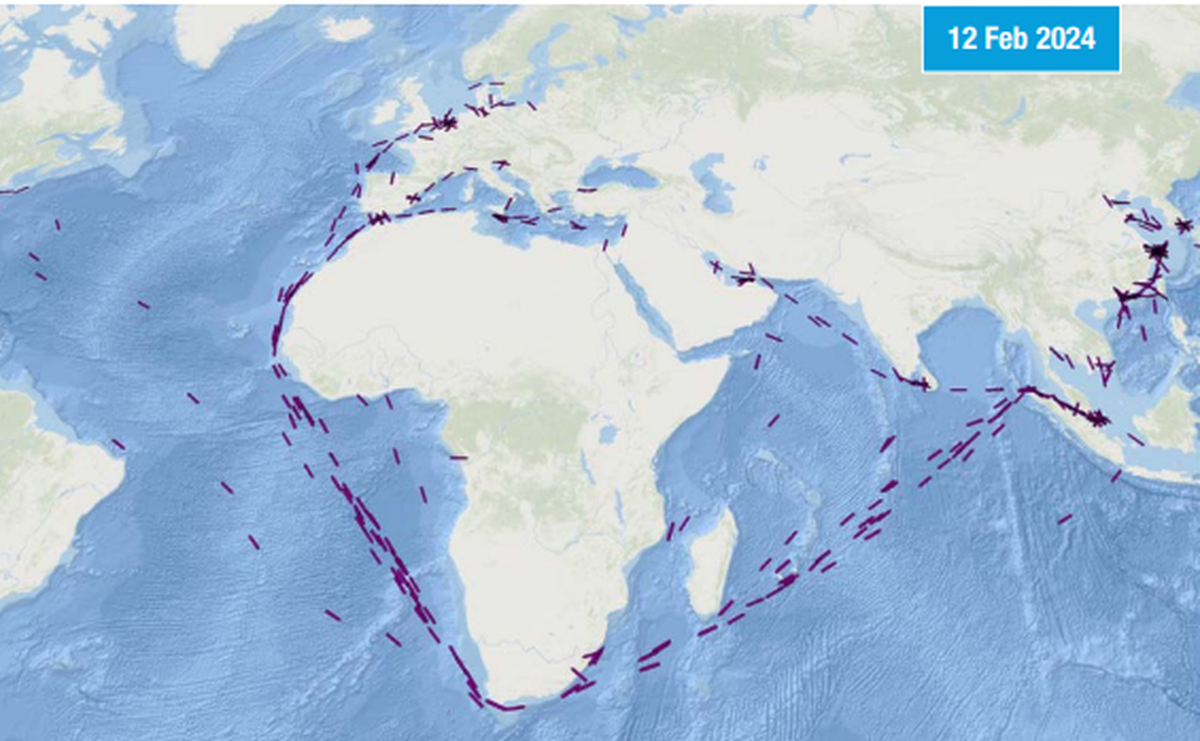

Map 2 | The map shows the route taken by container ships through the Cape of Good Hope after attacks on the Suez Canal route. The small rectangles in the maps correspond to containers. Map not to scale.

Maps appear incomplete? Click to remove AMP mode

The maps show how the container ships shifted from the Suez Canal route before the attacks to the Cape of Good Hope route after the attacks.

The disruption in the Red Sea has come at a time when the Panama Canal is also under stress. The canal has been facing low water levels due to drought. As a result, fewer vessels are transiting through it.

Chart 3 | The chart shows the number of monthly transits through the Suez Canal and Panama Canal from October 2021 to January 2024.

In January 2024, monthly transits went down by more than 40% in the Suez Canal and by 50% in the Panama Canal compared to the period when transits were at their peak. While the decline in the Suez Canal is a recent phenomenon due to the attacks, transits through the Panama Canal have been decreasing over the last two years.

Also read | Attacks in the Red Sea by the Houthis may hit India’s oil trade | Data

As ships have been re-routed from the Suez Canal, the distance they travel has increased. For instance, an oil tanker starting from the port of Ras Tanura in Saudi Arabia to Rotterdam in the Netherlands will have to travel 10,358 km if it chooses the Suez Canal route. The alternative journey around the Cape of Good Hope is 17,975 km. This means that the Suez Canal cut the distance by 42%. The UNCTAD report said, “Today, there is no ideal alternative to the Suez Canal, especially for Asia–Europe and Asia–North Africa trade.”

Chart 4 | The chart shows the average distance travelled in nautical miles every year by various types of cargo containers.

The average distances travelled by dry bulk and oil containers have significantly increased in 2024 (Chart 4). Dry bulk containers carry products such as grains, coal, ores, and cement.

The extra distance travelled has translated to higher shipping costs. Container freight rates for Asia-Pacific to Europe routes have increased significantly since November 2023.

Chart 5 | The chart shows container freight rates from February 2014 to February 2024 in $ per container per shipment.

The average container spot freight rates surged by $500 in the last week of December 2023. This was the highest ever weekly increase (Chart 5). Container spot freight rates refer to the cost of shipping goods in a container via sea on a single journey without a long-term contract at the current market rate. The surge in freight rates has had ripple effects with the rates increasing in locations across Asia and the United States’ western coast as well.

India is also impacted by these attacks as Russia — the source of most of India’s oil — sends its oil containers through the Suez Canal. As of today, the situation in the region has not impacted the domestic fuel prices in India. India is also increasingly becoming a significant player in petroleum products export, as it refines crude oil into petrol and diesel and sends these products to European countries, especially the Netherlands. This also requires the Suez Canal route; otherwise, the export costs would significantly increase making it unviable.

Source: UNCTAD report titled ‘Navigating troubled waters’

Listen to our podcast | When sky has a limit: The looming space debris crisis | Data Point podcast

[ad_2]

Source link